Denmark, a stalwart member of the European Union (EU) since 1973, presents a unique case within the Eurozone. Despite its EU membership, Denmark has opted to retain its national currency, the Danish krone (DKK), rather than adopting the euro. This decision reflects a complex interplay of economic, political, and social factors, which we will explore in this comprehensive analysis of Denmark’s relationship with the Eurozone.

Historical Background

Denmark’s journey within the European Union dates back to 1973 when it joined alongside the United Kingdom and Ireland. However, unlike some of its EU counterparts, Denmark chose to maintain its monetary sovereignty by not adopting the euro. This decision was solidified through a series of referendums, where Danish citizens expressed concerns over potential loss of control over their currency and economy.

Economic Implications of Opting Out

Denmark’s decision to remain outside the Eurozone has both advantages and drawbacks. On the one hand, it allows Denmark to retain control over its monetary policy, enabling flexibility in responding to economic fluctuations and crises. Moreover, it provides a hedge against economic shocks within the Eurozone, as Denmark can adjust its currency independently to cushion its economy.

However, the decision to retain the Danish krone also poses challenges. It limits Denmark’s integration within the larger Eurozone economy, potentially hindering trade and investment opportunities. Moreover, it necessitates maintaining currency exchange mechanisms, adding complexity to cross-border transactions with Eurozone countries.

Exchange Rate Policy

Despite not being part of the Eurozone, Denmark maintains a close relationship with the euro through its participation in the EU’s Exchange Rate Mechanism (ERM II). Under this framework, the Danish krone is pegged to the euro within a narrow fluctuation band, ensuring stability in exchange rates. This arrangement provides benefits such as reduced exchange rate volatility and enhanced confidence in trade and investment.

Trade and Investment Relations

Denmark enjoys robust trade and investment relations with Eurozone countries despite not using the euro. The European Union collectively serves as Denmark’s largest trading partner, with goods and services flowing seamlessly across borders. Moreover, Denmark attracts significant foreign direct investment (FDI) from Eurozone investors, leveraging its stable economy, skilled workforce, and business-friendly environment.

Policy Alignment and Cooperation

While Denmark maintains its monetary independence by not adopting the euro, it aligns its economic policies with EU guidelines. This alignment ensures coherence in areas such as fiscal responsibility, competition policy, and market regulations. Additionally, as an EU member state, Denmark actively participates in Eurozone discussions and decision-making processes, contributing to policy dialogues and fostering cooperation.

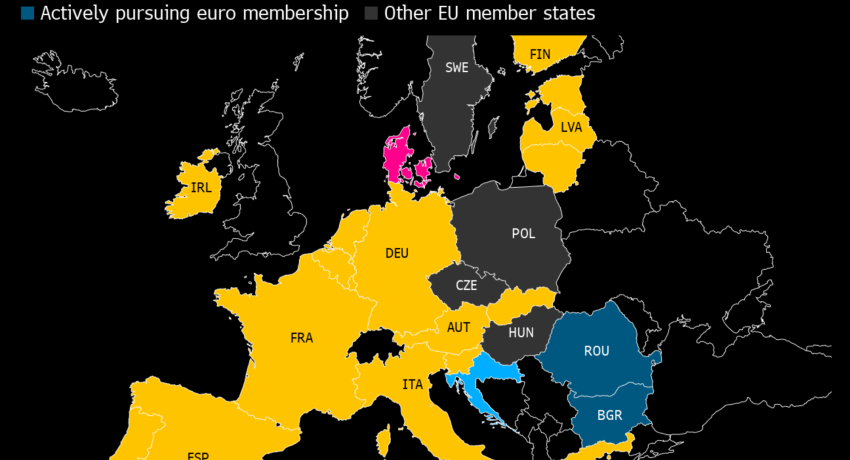

Prospects for Euro Adoption

The debate over Denmark’s potential adoption of the euro persists, with diverging opinions among policymakers and the public. Proponents argue that joining the Eurozone would enhance Denmark’s economic stability, promote deeper integration within the EU, and facilitate cross-border transactions. They emphasize the benefits of a common currency, such as eliminating currency exchange costs and enhancing price transparency.

However, opponents express concerns over potential loss of sovereignty and economic control associated with euro adoption. They point to the challenges faced by some Eurozone Dubai during economic crises, highlighting the importance of maintaining flexibility in monetary policy. Moreover, the issue of joining the Eurozone remains politically sensitive, with public sentiment playing a crucial role in shaping Denmark’s stance.

External Economic Factors

External economic factors, such as global market trends and geopolitical developments, also influence Denmark’s relationship with the Eurozone. Uncertainties surrounding Brexit, for instance, have prompted Denmark to reassess its position within the EU and its implications for the Eurozone. Moreover, ongoing discussions on the future of the Eurozone, including reforms and governance structures, may impact Denmark’s decision-making process.

Denmark’s position within the Eurozone is characterized by a delicate balance between economic pragmatism and national sovereignty. While opting out of the euro offers advantages in terms of autonomy and flexibility, it also entails challenges in terms of integration and cooperation within the broader European context. As Denmark navigates its future path, the dynamics of its relationship with the Eurozone will continue to shape its economic and political landscape.